So you or your loved one have turned 65 years old. This is a big milestone.

As age 65 approaches, you have probably been hearing A LOT about Medicare.

You are now at the official age where you can collect your Social Security Retirement check and can enroll in Medicare.

What is Medicare?

Medicare is the health insurance program funded by the federal government that you have been paying into while employed. Now it’s your turn to collect. You’ve likely been seeing a lot of commercials or promotional mail referring to the Medicare enrollment period.

So what is the Medicare enrollment period?

There are two enrollment periods for Medicare. First is the “Initial Enrollment” period and then there is the “Open Enrollment” period. I’m going to review these two enrollment periods with you. You’ll learn what the differences are and what to do during these periods.

Initial Enrollment Period

Qualifying to receive Social Security benefits also qualifies you to receive Medicare parts A and B. You have the opportunity to enroll in specific plans or opt out of certain parts of Medicare during this time.

The “Initial enrollment period” occurs 3 months before your 65th birthday, your birthday month and 3 months after your 65th birthday.

For example if your birthday is in July, the Initial Enrollment period for signing up for Medicare starts in April. It includes the month of July and ends in October.

Medicare has several parts to it. There is Medicare part A, Medicare part B, Medicare part C and Medicare part D. These “parts” of Medicare have different functions and provide different services.

Medicare basically offers an “a la carte” health insurance plan when you turn 65. You can decide which services you want to pay extra for and what you don’t want to pay for. Medicare part A is free, but Medicare parts B, C and D do have a premium cost.

The Parts of Medicare

- Medicare Part A- covers inpatient hospital stays, a short stay at a skilled nursing facility for rehab and part of home health care services. There is no out of pocket premium cost for this part of Medicare.

- Medicare Part B- covers doctor’s visits, outpatient services, physical and occupational therapies, and certain medical equipment you may need to recover or for physical safety purposes. There is an out of pocket premium cost for this part of Medicare.

- Medicare Part D- is a prescription plan to help cover the cost of your medications. There is an out of pocket premium but your State may offer an assistance program if the cost is too high.

Ok, so did we have A, B, and D, did they just decide to skip a part C?

No, Medicare part C is considered the Medicare Advantage plans. Medicare Advantage plans are private insurance companies that work as a third party to manage your Medicare insurance. Advantage plans basically offer an all-inclusive type of deal rather than Original/Traditional Medicare’s a la carte service.

There are certainly advantages and disadvantages to choosing Medicare part C or a Medicare Advantage plan. You can see the previous posts where we talked about the differences between “Traditional Medicare” and “Medicare Advantage Plans”.

- Medicare Part C- the Medicare Advantage plans, they bundle Medicare parts A, B and D for either a $0 premium or a very low of pocket premium (example: $50 a month). They manage your Medicare plan and determine where you go and what services are appropriate during a medical need. Check out the Medicare Advantage Plans post for more details.

How Much Does Medicare Cost?

I mentioned that Medicare part A is free if you are eligible. Medicare parts B, C, and D have an out of pocket cost. So how much are these out of pocket premiums?

Well, the short answer is, it depends. Ugh, I hate that word, depends. Depends on what?

Just like everything else, it depends on your income. It is determined by your IRS tax returns every year. Just like taxes, the amount of income you report will determine the amount you pay. The sliding scale that is used by social security is known as the “Modified Adjusted Gross Income” or MAGI.

The Medicare Secret No One Tells You…

Here is the deal, there is a catch if you don’t sign up for Medicare parts A, B or D during the initial enrollment period. What no one tells you is that you could face an enrollment penalty later on. This means you may have to pay a higher premium until you DO sign up for the health benefits. Ugh, stupid right?! But it’s important for you to be aware! I don’t want you stuck with extra costs. It’s hard enough surviving on the little income you get from retirement.

Open Enrollment Period

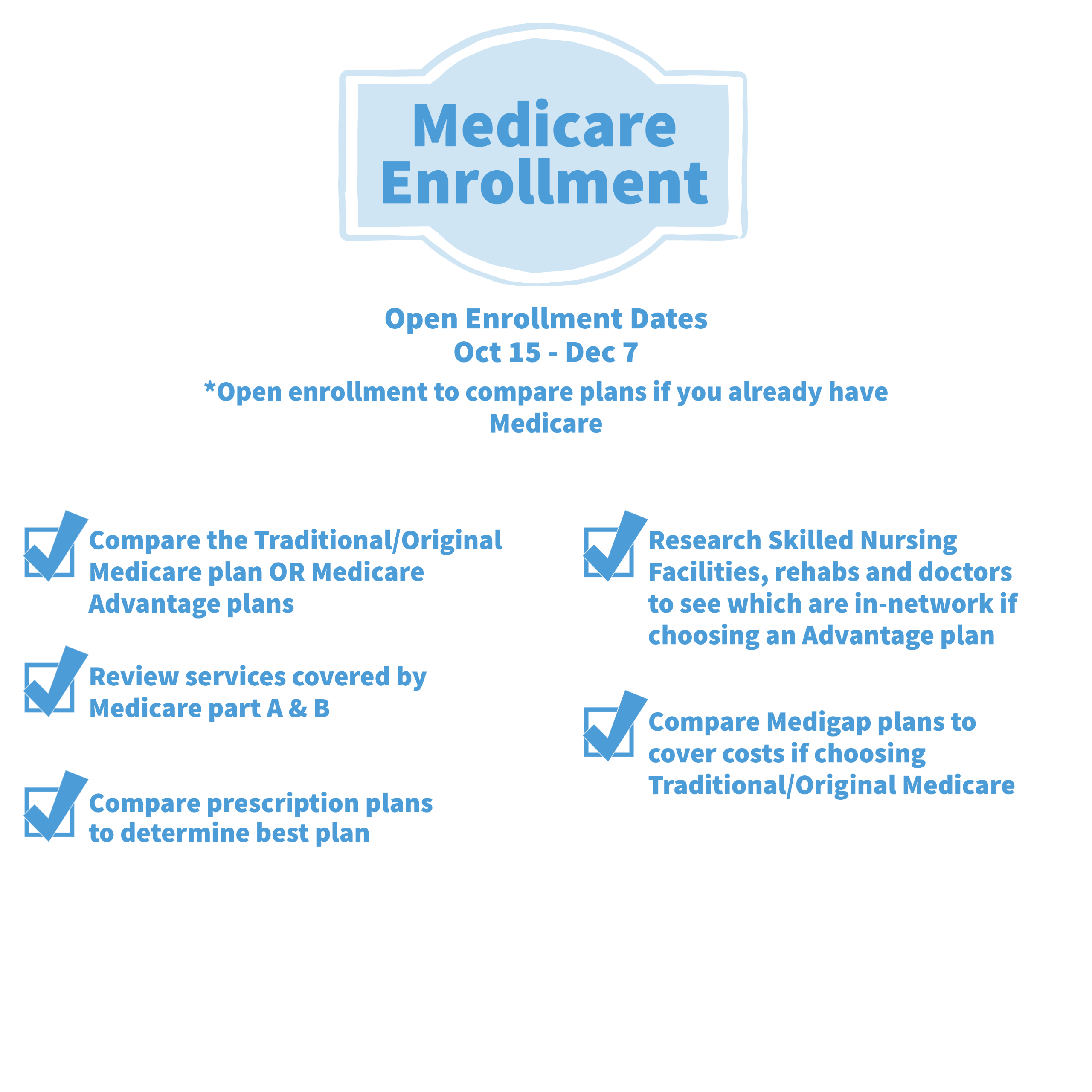

Ok, so you already have Medicare. You’ve had it for a year or several years now. Every year you should be hearing about the magic “open enrollment period”. The Open Enrollment period allows you to make changes to your Medicare plan.

The Medicare enrollment period is from October 15th to December 7th. If you have a Medicare Advantage plan, the open enrollment period is the time to change your plan without penalty. This is the best time for you to research all of the current Medicare plans and options to decide which is going to work best for you the upcoming year.

There are so many options and it can be very overwhelming. Ads and television fill our daily lives influencing our decisions, and healthcare is no different. You may find more advertisements and receive phone calls from various health insurance companies looking for your business.

They are typically selling you Medicare Advantage plans. You can compare all of the Medicare Advantage plans by going to the Medicare.gov website and use their comparison tool.

How to Make Changes to Your Medicare Plan During Open Enrollment

It’s actually pretty simple, you can create a personal account on Medicare.gov. You can also call Medicare at 1-800-MEDICARE (1-800-633-4227). If you have found a Medicare Advantage plan you want to sign up for, you can just call that insurance company or visit their website to sign up for their plan as well.

There are so many things to consider when selecting or switching your Medicare insurance plan. It can be hard to keep track or remember what to look for when making any changes. Here is a short checklist of what you to do or consider during the open enrollment period.

Your Medicare Enrollment Checklist

- Review your current plan and think about what services you have used over the past year

- Review the services offered by Traditional/Original Medicare

- Consider the costs of your medications and compare Prescription plans

- Research the skilled nursing facilities and rehab centers in your area and see which Advantage plans are in-network with the facilities that have the best quality care

- Check to see if your doctor or doctor you plan be established with is in network with the insurance plan you are considering

- If you are going with Traditional/Original Medicare, consider getting a Medigap or Medicare supplement plan

- Compare the overall premium costs of all Medicare plans

- Decide if you are ok with being restricted to only certain providers and allowing the Advantage plans to determine what kind of care you will receive and where

No responses yet