If you or your loved one have Medicare insurance coverage, you likely have Medicare Part A, Medicare Part B, and/or Medicare Part D. It’s possible that you have only one of these, a combination or all of these.

Check out my post “What No One Tells You About Medicare Enrollment Period” for a synopsis of what each Medicare Parts are.

In this post I will dive into the coverage benefits of Medicare Part A. In future posts I’ll discuss the coverage of Medicare Part B, Medicare Part D

and

Medicare supplement plans (also known as Medigap plans).

What is Medicare?

Let’s briefly review what Medicare is:

Medicare is the health insurance program that is funded by the federal government.

Anyone who is a US Citizen or Permanent resident that is able to collect social security, is eligible for Medicare benefits.

You are able to access your Medicare benefits automatically when you turn the age 65 and start receiving your social security retirement benefits.

Other ways you are eligible to qualify for Medicare benefits include:

- If you are age 65 and receive Railroad Retirement Board benefits

- If you have been diagnosed with end-stage-renal disease (ESRD) and require regular dialysis treatments or a kidney transplant AND either you or your spouse have worked the required amount to receive social security benefits.

- You are disabled and are receiving disability benefits from social security for at least 24 months

- You have been diagnosed with ALS (Lou Gehrig’s disease) and have applied for the social security or Railroad Retirement Board cash benefits

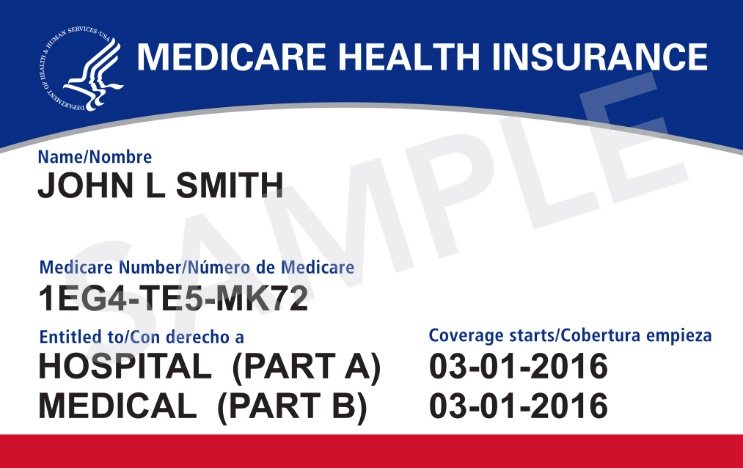

Medicare has different kinds of coverage. The areas of coverage are divided between the different “parts” of Medicare. If you have received your Medicare card, you will notice that it looks like this:

As you can see above, it shows that there is a Part A and a Part B.

These are the different “parts” of your Medicare insurance benefits.

However, sometimes it may show only Part A or Only Part B.

This means that you have opted out of one or the other coverage options. If you have questions about this, you can contact Medicare at 1-800-MEDICARE (1-800-633-4227) or by going online to their website at www.medicare.gov

Services Covered by Medicare Part A

Now, I am going to focus on the coverage of Medicare Part A. Medicare Part B benefits will be covered in a future post.

Medicare Part A covers acute services. Acute services are conditions that are severe with a sudden onset. This could be anything from a broken bone to a stroke.

Below are the “acute services” Medicare Part A covers:

Inpatient Hospital Care

Medicare Part A will cover your hospital stay as long as you are admitted under “inpatient” status.

This means that the admitting doctor has written admitting orders that say you meet hospital and Medicare criteria to meet “inpatient” status.

You can learn more about inpatient hospital status in a future post.

Hospital Services covered under your Medicare Part A benefit include:

- the cost of the room (usually just semi-private rooms)

- meals

- nursing care

- medications as part of your treatment

- any other testing, procedures or supplies as part of your inpatient treatment

What it does NOT include:

- Doctor’s services (this usually gets billed under Medicare Part B)

- Private Duty Nursing

- Television/Cable or phone in your room

- Personal care and supplies

- Equipment you may need when you are discharged

Will You Have a Co-Pay?

Yes. You do have a deductible that has to be met for each benefit period.

A benefit period starts the day you admit to a hospital or rehab facility for inpatient care. The benefit period ends when you have not received any inpatient care for at least 60 consecutive days.

Per Medicare’s website, the deductible amount you are responsible for each benefit period is $1,484.00 for the year 2021.

After your deductible has been met there is a $0 co-pay for the first 60 days of care.

- Days 61-90 you may owe $371 co-pay

- Days 91+ you may owe $742 co-pay

Short Term Rehab

If you haven’t yet, check out my post on Planning for Care After a Hospital Stay. This talks about the different types of care there are when you discharge from a hospital and what to expect.

It also talks about the types of rehab available to you and the differences between them.

Medicare Part A will pay for the following types of medical rehab care:

Long-Term Acute Care Hospital – this is extended acute hospitalization treatment for medically complex patients. The average length of stay is about 25 days.

Acute Rehab Hospital– this is intensive inpatient rehab that requires a minimum of 3 hours of physical therapy and occupational therapy daily with the goal of going home.

Skilled Nursing Facility– this is the most common type of inpatient rehab. It is less intensive but still effective. Patient will receive daily physical therapy and occupational therapy.

Skilled Nursing Facility Coverage

Medicare Part A will pay for skilled nursing rehab at 100% for the first 20 days. There is no co-pay or deductible associated with this.

If further rehab is needed after 20 days…

Days 21-100, Medicare will pay 80% leaving you responsible with a 20% co-pay.

For the year 2021 the 20% Co-pay amount is $185.50 per day.

This coverage includes:

- Room

- Meals

- Nursing Care

- Physical Therapy

- Occupational Therapy

- Speech Therapy

- Social Work Services

- Medications

- Medical Supplies and Equipment Use

- Ambulance Transportation

- Dietitian services

It does NOT include:

- Television/Cable

- Phone use

- Private Duty Nursing

- Doctor’s Visits/Care

- Personal Care and supplies

- Equipment you may need when you are discharged

Hospice & Palliative Care

Hospice Care is covered by Medicare Part A as well. To find out what Hospice care is and how to qualify, Check out my post What is Hospice Care and What are the Benefits?

Also check out my Palliative Care post: The Truth About Palliative Care: The What, Who, How & Why

There is no deductible or copay for Hospice care itself. However, there may be a Co-pay for Prescription Medications of $5 for each medication if you do not have a prescription insurance plan.

Hospice care includes:

- Nursing Care and medical services

- Medication Management

- Doctor Services

- Medical Equipment Needs for comfort care

- Spiritual and Emotional Support

- Social work services

- Dietitian services

- Inpatient Respite Care

It does NOT include:

- Nursing home care

- Room and board at a facility long-term

- Meals

- 24/7 care

- Outpatient Prescription Medications

Home Health Care

If you aren’t sure what home health care is, there is a whole post about what it is and what services are included at my Beginner’s Guide to Home Health Care Services. Check it out!

As long as a doctor certifies that you need home health services and you meet homebound criteria you Medicare can cover home health services.

Will You Have a Co-Pay?

No. You pay $0 for home health care services. There is NO deductible or co-pay.

However, if you are needing any medical equipment or devices under home health care services, there is a 20% co-pay for the amount of time that you used the equipment.

Home Health Care includes:

- As needed nursing care

- Physical Therapy

- Occupational Therapy

- Speech Therapy

- Medical Social Work Services

- Part-time or limited home health aide services

- injectable osteoporosis medications for women

It does NOT include:

- 24/7 care at home

- Meals

- Homemaker or cleaning services

- Personal care (bathing, dressing, toileting care)

Hopefully I was able to give you a better understanding of Medicare Part A and what it covers. There is so much involved with health insurance and Medicare, it’s difficult to know what is what.

Unfortunately I don’t feel our society and healthcare system does a very good job with providing education and information about services that are available. It makes navigating the healthcare system extremely difficult.

If you have any other questions about Medicare Part A, or have a specific situation you would like to discuss with me, feel free to shoot me an email!

No responses yet