I have covered A LOT so far about Medicare and how it works. If you haven’t already, check out the following posts about the different parts of Medicare:

Services Covered by Medicare Part A

Why You Should Care About Medicare Part B

I realize it might be hard to keep up with all of this information. There is just so much! And I want to make sure you are equipped with knowledge to make the most informed decision about your health!

Medicare Supplement Insurance (Medigap Policies)

Now I’m going to talk about Medicare Supplement Insurance, also known as Medigap policies.

Medigap helps cover everything that Medicare Part A, B, and D have not covered.

If you recall, there are co-pays you will still have with your Medicare health insurance. A Medigap policy helps pay for those co-pays.

It essentially covers the gaps in your Medicare Health Insurance.

Let’s dive in a little deeper…

What is a Medigap Policy and How Will it Help Me?

I spend a lot of time at the hospital educating patients and family about their Medicare benefits, One of the most important things I talk to them about is Medigap.

Now I can get on my soap box and talk about how I think Traditional Medicare with a Medicare supplement plan is in everyone’s best interest…..but for now I’ll try and stay objective.

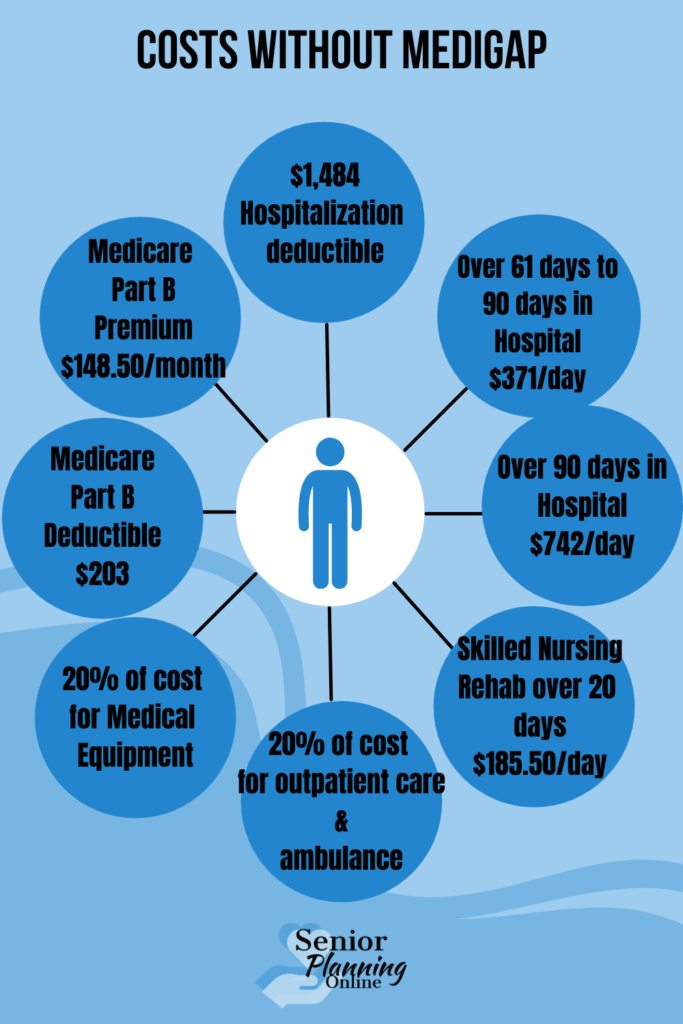

If you have Traditional Medicare Parts A, B and D, there is a lot of coverage. But there is also a lot of gaps in coverage.

Lots of co-pays and deductibles you have to pay for the coverage.

A Medicare Supplement Plan (Medigap) helps fill in those gaps of coverage. It can pay for the deductibles and co-pays.

These Medigap Plans are also known as Medicare Part F and/or Medicare Part G.

Examples of How Medigap Plans Work

Many of the patients and families I work with at the hospital find themselves with a need for continued care after the hospitalization.

Often times this is in the form of a rehab program, either a skilled nursing facility or an acute rehab program.

Medicare Part A only pays 100% for the first 20 days of rehab at a skilled nursing facility.

After the 20 days, the patient is responsible for a 20% co-pay.

For 20201, that 20% is in the amount of $185.50 per day!

So if you need a total of 30 days of rehab, there are an additional 10 days that is only covered 20%. So now you are looking at $1,855.00 out of pocket for those 10 days.

Imagine if you need longer than 30 days! Depending on the severity of your condition and your progress, you could rack up a large bill.

However, If you have a Medicare Part F or Part G plan, this additional plan will cover that 20% cop-pay. This gives you the 100% full coverage you need, and way less stress!

What is Covered Under a Medigap Policy?

There are several different Medicare supplement insurance plans to choose from. Depending on the policy your coverage will vary.

However, in general, most of the Medigap policies will cover the following:

- Additional costs for Hospital Stays

- Skilled Nursing facility care up to 100 days

- Hospice Care

- Home Health care

- Medical equipment costs not fully covered under Medicare Part B

- Tests and diagnostics not covered by Medicare

- Emergency care and Emergency Travel

- Emergency Foreign Travel expenses

What is the Cost of a Medigap Policy?

Ok, so perhaps you are now convinced that a Medigap Policy is in your best interest. But what about the cost of this policy? Obviously it isn’t free.

So it depends on what policies are offered in your state. Medigap policies are provided through private health insurance companies that are required to follow the Medicare guidelines.

It also depends on what kind of coverage you are willing to pay for. Are you wanting all deductibles and co-pays paid for? Or are you ok with only certain co-pays and deductibles covered?

In general, a Medigap Policy premium can range from $30 per month to $950 per month.

Premiums also vary depending on your age. Sometimes the younger you are, the lower price you can lock in for your premium.

If you are someone with a lot of co-morbidities and have already had a few hospital stays, getting a Medigap plan may be in your best interest to save you money in the long run.

If you think about all of the co-pays and deductibles you would have to pay, you could end up saving thousands of dollars.

How Do I Choose a Medigap Policy?

So how do you choose a Medigap policy?

There are so many companies out there that offer these Medicare Supplement policies. Some of them you probably have heard of already.

Examples include AARP, Aetna, Bankers Fidelity, Blue Cross Blue Shields, Cigna, Colonial Penn Life, Mutual of Omaha, State Farm and even USAA.

You can browse through the different Medigap policies offered on the Medicare website. Check out the Medicare.gov’s Medigap finder page.

I think the best way to go about choosing a plan, is to first review your own medical history. Figure out your needs and try to anticipate the care you will need in the future.

If you are someone with a lot of health conditions, you may want to choose a company and a plan that will provide full coverage. This may be a large premium, but it will cost you a lot more in the long run if you have a lot of health needs.

You can also change your Medigap plan each year during the Medicare enrollment period.

Questions?

If you have any questions about Medicare Supplemental Insurance (Medigap), feel free to send me an email. I’m happy to give you more details about the plans and my personal opinions on the plans. I can tell you which plans seem to work best for the patients and families I see at the hospital.

2 Responses

What thanks for the information

Grateful for sharing detailed information regarding medicare insurance plans and what services they include in each plan