So I’ve been talking about the Medicare health insurance program. If you haven’t already you should check out the following posts as part of my Medicare series!

Services Covered by Medicare Part A

Why You Should Care About Medicare Part B

Prescription Coverage through Medicare Part D

How to Fill in the Gaps of Health Coverage WITH Medicare Supplement Insurance (Medigap)

So there is one more BIG part of Medicare I want to talk to you about. And that is….Managed Medicare Plans, also known as Medicare Advantage Plans.

Did you know?

More than 21 million people are enrolled in a Medicare Advantage Plan, according to the Centers for Medicare & Medicaid Services (CMS).

21 million people! 61 million people are enrolled in the Medicare health program, so that means 21 million of them have the advantage plan.

Hold on, hold on, hold on…..so what the heck is the difference between Medicare and a Medicare Advantage plan?

Keep reading and I’ll give you all the details, AND I’ll give you my personal opinion on the plans!

What is a Medicare Advantage Plan?

So a Medicare Advantage plan is a private health insurance company that manages your Medicare benefits. Essentially Medicare pays the health insurance company a negotiated rate to manage all of the different parts of your Medicare. That includes, Medicare Part A, Medicare Part B and Medicare Part D.

In other words, your Medicare parts A, B and D are all enrolled into one little bundle.

In return, the health insurance company offers you a lower premium, lower co-pays and additional services that are not necessarily covered under your Medicare benefits.

Extra Services That May Be Covered Under Medicare Advantage Plan

Depending on the company and plan, some of these Medicare Advantage Plans will offer services such as:

- Dental

- Hearing

- Vision

- Transportation to doctor visits

- Over the counter medications

- Various wellness programs/incentives or preventative services

If you recall, you do have premiums and co-pays with Medicare Part B and Medicare Part D under Original Medicare.

Original Medicare vs Medicare Advantage

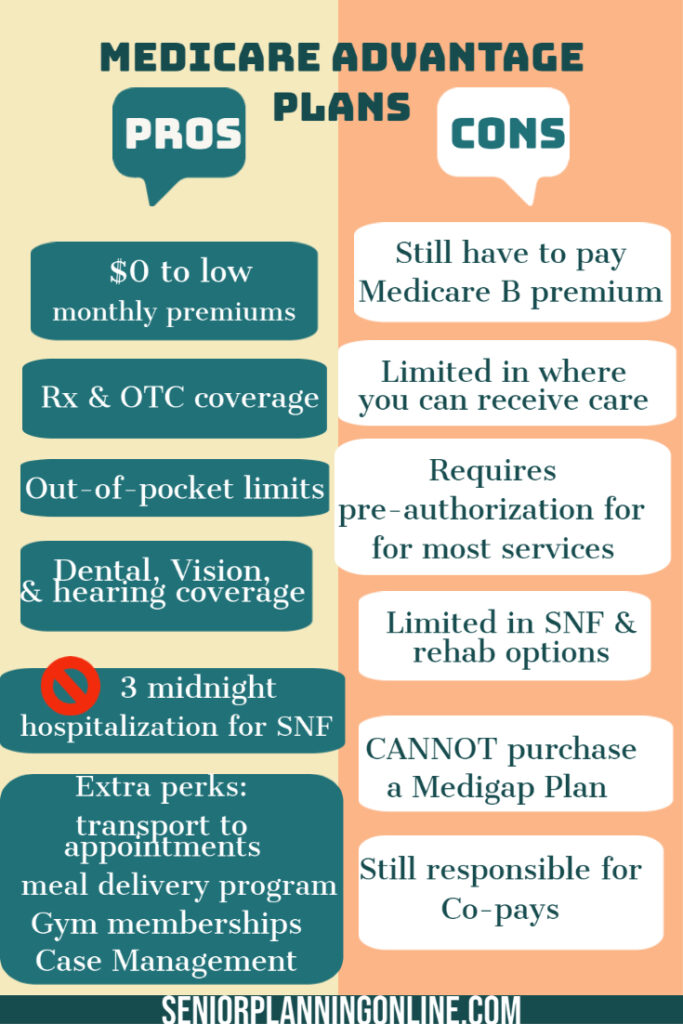

So what are the pros and cons of a Medicare Advantage vs Original Medicare?

Pros:

- Low to ZERO monthly premiums

- Includes a medication plan, so you don’t have to search for a separate Medicare Part D plan

- May include over the counter medications

- They have an annual out-of-pocket limit

- Many plans offer transportation to and from doctor visits

- Many plans offer wellness programs and incentives such as gym memberships, access to fitness classes, a meal delivery program after a hospital stay, etc.

- Care management services- nurses and social workers available for you to check in with for community resources and for wellness checks.

- Offers Dental, Vision and Hearing coverage

- You don’t have to wait 3 midnights as inpatient at a hospital to go to a skilled nursing facility, you can really go after any length of stay at a hospital, outpatient or inpatient.

- Sometimes you can go to a skilled nursing facility from home without a hospital stay

Cons:

- Coverage for dental, vision and hearing coverage may be limited and you will still have some out-of-pocket expenses depending on the needs

- Certain plans may only cover certain medications

- Some plans require you to still pay your Medicare Part B monthly premiums

- Gym memberships and access to fitness classes may not apply to you if you are limited in your physical capacity due to a chronic and severe illness

- Transportation to and from doctor visits are limited, you typically have a set number of visits you can get transportation for annually

- You are limited in what doctors and specialists you can see; you have to use their in-network list of physicians that are contracted with that specific plan

- You are limited in what hospitals and rehab facilities you can go to. They may not be the best quality and rated facilities.

- You have to get pre-authorization for most tests, procedures, hospital stays and rehab stays.

- It can be difficult to get approval for a skilled nursing facility and even more difficult for acute rehab or LTAC level of care.

- If you are able to get into an acute rehab or LTAC, you typically have a high deductible or co-pay

- They typically won’t pay for skilled nursing rehab after 20 days

- You cannot purchase a Medigap/Medicare Supplement Plan if you have a Medicare Advantage Plan.

Cost of a Medicare Advantage Plan vs Medicare

So, I briefly touched on the costs of plans but let’s break it down.

Medicare Advantage Plan

Premium costs of a Medicare Advantage Plan can be quite enticing!

What is the monthly premium for a Medicare Advantage plan? Depending on the Medicare Advantage Plan, your monthly premiums can range from $0 to $100 a month.

In my experience, the average premium cost is usually between $20 to $50 a month.

Are there any other premiums you have to pay for? Remember, you usually still have to pay your monthly Medicare part B premium of $148.50.

What are the premiums for a Prescription plan? No additional premium for prescription plan. This is included in your Medicare Advantage plan premium.

Original Medicare

With Original Medicare, you have Parts A, B, and D. You can also get a Medigap plan.

What is the monthly premium cost of Medicare Part A? $0

What is the monthly premium cost of Medicare Part B? $148.50 if your annual gross income is less than $88,000 for an individual, or less than $176,000 as a couple.

What is the monthly premium cost of a Medicare Part D plan? Depending on your plan, premiums can range from $7 a month to $100 a month

What is the monthly premium cost of a Medigap Plan? Premiums can range from $30 a month to $950 a month depending on the plan you get

Remember that both a Medicare Advantage Plan and Original Medicare have deductibles. Deductibles vary with a Medicare Advantage Plan, it just depends on the company and plan you choose.

Original Medicare has a set deductible. You can find more information about them on this post: Services Covered by Medicare Part A.

Additionally, you are still responsible for your Medicare Part B premiums with both Medicare Advantage Plans and Original Medicare. That means you also are responsible for the Medicare Part B Deductible.

Choosing Between Medicare vs Medicare Advantage Plan

I’ve broken down both Medicare Advantage Plans and Original Medicare for you. For most people, Medicare Advantage Plans sound more enticing. Mostly because of the additional services they may offer.

When I meet with my patients at the hospital, and they have a Medicare Advantage Plan, I try to educate them about their plan. Most of my patients don’t even realize what is and isn’t covered under Medicare Advantage.

The premiums sounded good and so did the sales rep, selling the additional services offered by an Advantage Plan.

In my opinion, I think Advantage Plans are great if you meet the following criteria:

- Have NO co-morbidities (2 or more diseases or medical conditions)

- Have had less than 2 hospitalizations in the last year

- Are under 80 years old

In my personal opinion, based on my experience as a Medical Social Worker, if you meet ANY one of those 3 criteria, it may be in your best interest to consider Original Medicare and a Medigap plan.

Additionally, I think that if you choose Original Medicare plan, you really SHOULD have a Medigap plan as well. However, that may not be necessary if you have private funds to cover any co-pays and extra expenses. OR, if you are at least 70% services connected with the VA.

Why is This My Recommendation?

Again, this is my personal opinion based on what I’ve seen as a hospital social worker. The reason why I recommend this is because of the limitations an Advantage Plan has with your care. With a Medicare Advantage plan, you can only doctors and specialists covered in that network.

Advantage Plans dictate where you receive your care and what kind of care you can get. This is especially true when it comes to going to a rehab facility.

First off, if you need acute rehab care or LTAC care, it’s nearly impossible to get approved by an Advantage Plan. If you somehow magically get approved, you will have a large co-pay. Like $300 per day! Sometimes more.

Also, if you need skilled nursing rehab, the Advantage Plan has to approve it. They not only get to decide IF you can go, but WHERE you can go. And trust me, it may not be the best rated or quality facility. You can only go to the facility that is contracted with that plan.

If you need more than 20 days of skilled nursing rehab, it can be VERY difficult to get the Advantage plan to pay for more days. If you do need more than 20 days of rehab, you will still be responsible for a 20% copay of $185.50 per day. The problem is, you cannot have a Medigap plan to pick up that co-pay.

However, if you have Medicaid, Medicaid will pick up that co-pay as long as you go to a skilled nursing facility that is Medicaid certified.

Questions?

I’d love to hear your opinions about this post and answer any questions you may have about Original Medicare and Medicare Advantage Plans! If you want to discuss your particular situation with me, I would be happy to listen and offer advice.

Just send me an email using the form below!

No responses yet